Completed this work today. Quick summary from the author himself: “Work works”. “Pain means growth”

I am not a fan of famous people as I think most of them are overrated. Although I will always say his movies were very important as a child/teenager: Terminator 2, Conan, Predator, Commando. They are my favourites. But it seems to me this book was about the person so gave it a go.

He starts the book with the end of his political career due to cheating to his wife and the 2008 crisis. That made him to start again…

He shows the seven rules he is using in his life and I think the order is important because they start with yourself and at the end is more about others. It builds so you can “Be useful”.

1) Have a clear vision : You dont have to have everything worked out but have a overall goal. It’s like, why are you going to the gym? What’s your mission? He had his vision very early in life, but still it works at any stage. Make the space to get that vision: just walking can be very good. And to be honest, I have found going for a walk quite revealing lately, although I just talk to myself, it feels good to think aloud. And when you look at the mirror, is what you see what you want to be?

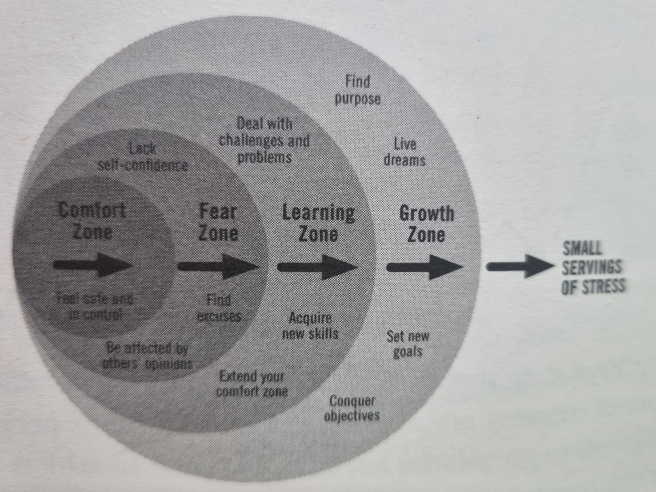

2) Never thing small: If you have an idea, go all in (no plan-b): “Wenn schon, denn schon” Ignore the naysayers, it is your dream, your life, your growth (whatever is the outcome). Seneca quote: “If you dont go through struggle, you don’t have a life”. There are several Stoics quote a long the book and that surprised me.

3) Work your ass off: That works 100% of the time. He says one the bases of success is repetition, repetition, repetition so it makes perfect. Embrace the boring stuff (fundamentals) and do often. Pain is temporary, the outcome is permanent. And you need to follow up (something the reminds me of a Russian saying: Trust but check). And you have time for it, make the numbers!

4) Sell, sell, sell: This makes sense obviously for business but personally, I need to do it in dating too. You can be a great catch, but if nobody knows about it, then…. So people need to know you and you need to know “who” is really the customer. And be yourself, own your (hi)story, for good and for bad. And in business , let them underestimate you, use it in your favor.

5) Shift gears: This is about to learn to adapt to changing situations. From learning from mistakes to change your mind when required. And learn to find the positive in shit moments. This is “amor fati” as defined by Stoics. Complaining is too easy and doesn’t get you anywhere. You learn from hardship. If you win the lottery, you will not look at the money as if you had build a successful business. Reframe failure, it is part of the learning process (ie: WD40 – there were 39 failures before…) Break the rules, make things better and not because they are that way. Risk is relative, really, what do you have to lose?

6) Shut your mouth and open your mind. This is about learning, always be open to learn (from anybody, any moment) So learn by listening. Be curious, as the “how” and “why”. Be that sponge. And with all that, put it in a good cause. It is interesting he criticises the current education systems as it seems you must have a degree to be successful and be rich. Firstly, you could have a good life being a baker that is fulfilling and do something good for the community.

7) Break the mirrors: And this is where you destroy the ego (you are not self-made) because from most of the other rules, they look very individual but then, you get here and you realize is not about you. It is about giving back so everybody wins. Can be small or big, depends on your circumstances. So be useful.